Financing Your First Home

Why America Needs Mortgages!

It is very apparent that the general public is overwhelmingly misinformed and misguided when it comes to real estate financing. Banks, credit unions, and other financial institutions are continuously viewed in a negative light. These institutions are seen as tenacious villains that would stop at nothing to steal every dime you earn. This apparent hatred for conventional lending institutions is perpetuated by the news media and by “finance gurus” who promise to protect you from the evil banks and get you out of debt…FAST!.

Have you ever heard the radio commercial from John Cummuta?? It starts by saying, “Mortgages should be illegal!”. He goes on to explain that throughout the term of a traditional mortgage, the borrower ends up paying more for his home because of the interest he owes to the bank. While the listener with a basic 5th grade education would understand that interest payments are a fundamental necessity of any kind of financing, I fear that many listeners would find themselves nodding their heads in agreement. As they listen to this ridiculous monologue from a self proclaimed “finance guru”, they become potential victims to yet another scam promising to “wash away your problems”.

The indisputable truth is that mortgages are absolutely essential to the American Dream of home ownership. If mortgages were indeed illegal, the more than 80% of home buyers who utilize mortgages to finances their home purchases would be renting and/or homeless. Does the average Western New Yorker have $150-$250K sitting in their bank account just waiting to be spent on a home purchase? Of course not! Hence the need for conventional financing.

The good news is that mortgages have several built in benefits that are intended to serve the borrower. The simple truth is that banks are interested in making low risk loans and getting their money back on a consistent basis. To this end, banks offer rather favorable terms and conditions. One such condition which is an attribute of almost all conventional financing is the ability to pay back your loan earlier than it is due. This means that you have the option to make larger payments that are required so you can save on your long term interest costs. The bank is willing to make less profit just to ensure that their investment is secure.

Will you Qualify for a Mortgage

Banks consider several factors when deciding if and how to lend you the funds to purchase your first home. The first factor they consider is your credit score. Your credit score is a quantifiable measure used to indicate your “creditworthiness”. That is, “How likely is it that you will make your payments to fulfill your debt obligations?”. Things that effect your credit score are the following:

- Payment History – 35%

- Current Outstanding Debt – 30%

- How Long You Have Had Credit – 15%

- Last Application for Credit – 10%

- Types of Credit you are Using – 10%

There is a lot that can be said about strategies for maximizing your credit score. That can be saved for a more detailed post. In general, if you make your payments, and don’t go crazy applying to 1,000’s of credit cards, you should be fine. If you are interested in buying your first home, chances are you have not filed for bankruptcy in your life. That is a good thing! Credit scores break down as follows:

- 726-850 -> Excellent

- 700-725 -> Good

- 626-699 -> Average

- 330-625 -> Poor

- 0-329 – >Limited / No credit

If your credit score is over 626 you can expect to be approved for some kind of mortgage. Obviously your terms and conditions improve the higher your credit score.

Another factor that has a major influence on your ability to obtain a mortgage is your current monthly debt obligations. That is, “How much do you owe per month to pay off your debt?”. This is the sum of all the mandatory payments you make on a monthly basis. This consists of student loan payments, credit card payments, car payments, payments on another mortgage, etc. The bank needs to know what other debts you have to pay off to ensure that you can afford to pay everyone and keep all your creditors happy. A factor that goes hand in hand with your monthly debt obligations is your pre-tax income. Banks need to know how much you make on a monthly basis to make sure you have enough money to pay off your debt and keep yourself alive with other costs of living. The bank will require you to provide at least 1 month’s worth of pay stubs from your employer.

There are many other factors that could come into play when applying for financing. These factors include potential rental income from the property you are trying to finance and income you generate from self-employment. These factors get quite complicated and will be addressed in a later post.

In general, the banks will use a combination of your credit score and your ability to make monthly payments to determine whether to approve you for a loans and for what amount you can be approved. When you hear of a person or family being “pre-approved” for a loan, this means they have been to the bank and have gone through this exercise. Getting a pre-approval letter is the first step toward getting serious about buying a home.

There are countless tools that allow you to get a quick idea of what kind of home you can afford. Give this a try to see where you stand: Yahoo Affordable Home Calculator.

To be Continued! – In the next post we will discuss where to go to seek out your first mortgage and what documentation will be required.

As always, you can check us out on Facebook / Twitter. Or on our website: http://www.nyhsolutions.com/

Real Estate Agent or No Real Estate Agent?

A key decision after deciding to buy a home is deciding whether or not to sign with a Real Estate Agent to help you throughout the process. NY Home Solutions has yet to sign a formal contract with a real estate agent, but we’ve met with and worked with a number of agents within the Western New York region. Speaking with real estate agents has helped to expand our network and to learn more about the process. We fully intend on hiring a selling agent for the final sale of our house on Mariner.

In almost all situations, I would recommend signing with a buying agent to purchase your first home. The main reason why signing with a buying agent is a good idea is that in almost all cases, ITS COMPLETELY FREE! Typically, the home seller pays the real estate agent commission. The seller’s agent charges a percentage of the sale prices once the house sells (typically between5.5%-7.5%). If the buyer also has agent representation, the selling agent splits the commission with the buying agent. Because most people use real estate agents, the above scenario takes place the majority of the time. This means that there is rarely any risk associated with hiring a buying agent. If they are able to help you find a house you like, Great! You get the house you want, and the seller pays your agent! If you aren’t able to find something you like in a set amount of time (typically 3-6 mos), the contract with the buying agent is void and you both go your separate way (that is if you do not decide to re-sign).

Below are some key advantages to signing with a Real Estate Agent when searching for a home:

- As mentioned, its usually FREE!

- They provide insight into average prices within your target market

- They will help you with negotiating the final sales price

- They can help you set up property insurance and utilities

- They will point out factors to consider that could be easily overlooked by the real estate novice.

- They typically have a large network of inspectors, mortgage brokers, contractors, and attorneys

- It’s always good to have someone else to bounce your thoughts off of!

Given the above list, you may be wondering why NY Home Solutions has yet to use a real estate agent for the purchase of a home. First, one of our core competencies is that we are able to close a real estate sale extremely quickly. This happens because both the home seller and NY Home Solutions are not represented by a real estate agent. The seller is not willing to pay a real estate commission fee, so he/she does not use an agent and would not be willing to pay for an agent representing NYHS. Another reason we do not use a buying agent is because we have built up a strong knowledge base of the Western New York real estate market. When buying a home, we are comfortable contacting the seller or selling agent, walking through the home, presenting an offer, and conducting negotiations. It is simply quicker for us to do these steps ourselves as opposed to having a real estate agent do it for us. However, we have built up strong relationships with several talented real estate agents. We look to continue to build upon these relationships and utilize their services in future real estate transactions.

If you are looking to buy your first home, its probably a good idea to sign with a buying agent. If you’re not sure where to start, try contacting one of the agents below:

Gino Albini– Realty USA (Grand Island)

Anna Baldo– Realty USA (Orchard Park)

Jackie Rice – Realty USA (Hamburg)

Amy Pasinski – Realty USA (West Seneca)

NY Home Solutions has no direct affiliation with any of the agents listed above.

Next post in this series: Financing Your New Home

78 Mariner – Redesigning the Kitchen

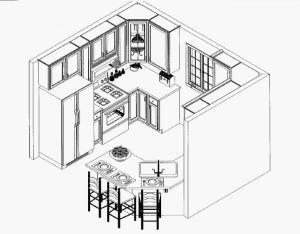

I mentioned how we decided to tear down the small 30 inch wall between the dining room and the new kitchen. This will open the place up and make the house seem a lot bigger. Real Estate experts agree that kitchens and bathrooms are the two most important rooms that influence a home buyer’s decision. Therefore, we decided to spend a significant percentage of our overall construction budget on the new kitchen (23%). To fit the character of the neighborhood, we’re going all out with new maple cabinets, granite counter tops, stainless appliances, tile back splash, and tile floors. Our kitchen also features a 3 person peninsula / breakfast bar. The breakfast bar is located in the area opened up by the removal of the 30 inch wall. Finally, the Kitchen will open to the refinished back porch and oversize backyard (when compared to the neighborhood).

We’re confident in the kitchen’s ability to give this house the “Wow” factor that we’re looking for. But we’re also confident we didn’t overdo it. We got very competitive prices on our counter tops and cabinets…and we’ll look to do the same for the flooring and appliances.

As always, check us out on Facebook / Twitter. Or on our website: http://www.nyhsolutions.com/

Search

Topics

- 78 Mariner (4)

- General (7)

- Quick Guide: Buying Your First Home (3)